Companion Program Signup

26 de junho de 2024Methspin: Australias Premier Online Casino Gaming

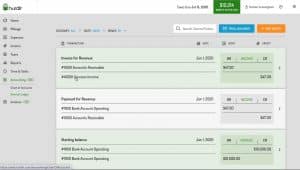

11 de julho de 2024Sadly, if you’re tracking earnings from each of the different apps, Hurdlr doesn’t treat these as totally different forms of revenue. As A Substitute, they deal with it like you’re operating fully completely different companies. Some won’t even let you track expenses that don’t match into their record of categories. This is the place I respect Hurdlr, in that you can customize expense categories. When I ran checks where I compared how well Hurdlr really tracked miles to my odometer readings, I found Hurdlr to be quite correct. The manual version was 100% accurate whereas the automatic monitoring was 98% correct.

Plan Pricing

After trying out totally different accounting/tracking apps, I found that Hurdlr finest suited my needs and ended up buying the premium version after the trial expired. I needed something easy the place I might observe my mileage, income, and expenses. I additionally needed something that provides me the required calculations and reviews https://www.quickbooks-payroll.org/ for quarterly estimated taxes and for when tax season comes around.

I like to take a look at expenses, and when my husband started driving for Uber and Lyft 3 years in the past, I knew he’d have to track one of the largest factors for rideshare drivers – mileage. Hurdlr has accomplished a superb job combining mileage, expense, and income monitoring functionalities in an easy-to-use app. It’s perfect for freelancers, unbiased contractors, and facet hustlers who wrestle to track enterprise finances and estimate tax burdens. The app additionally allows you to set work hours or time frames when it ought to observe mileage to simplify drive classification. But not like different mileage trackers, Hurdlr doesn’t auto-classify drives within work hours as a business.

Since the Hurdlr app can observe your revenue, it additionally has the flexibility to automatically calculate the amount of taxes you will owe. To track your miles with Hurdlr, merely leave the app operating within the background of your telephone. Hurdlr will document mileage between start and cease factors and all you have to do is inform the app if a trip was related to your business or not. Many users praise Hurdlr for its capability to simplify mileage tracking, expense management, and tax prep. You shouldn’t get much in the way in which of problems working the app edition of Hurdlr in your telephone as it’s been put collectively very properly certainly.

- If you’re willing to pony up somewhat money, you can also get a good better model for as little as $4.ninety nine a month, depending on which bundle you choose.

- Hurdlr additionally comes in a Pro version, which is $10 per thirty days and is billed yearly with no month-to-month cost choice out there.

- Even better, labeling them as business additionally allows you to see how these journeys flip into business deductions in your taxes.

- Beyond the auto characteristic, you can even add journeys manually by both tapping the “Start Tracker” button or entering all of the particulars after the very fact.

Total, MileIQ is a superb alternative for those in search of a hassle-free mileage tracking expertise. Its ease of use, automated features, and detailed reviews make it an ideal resolution for business house owners and individuals alike. Our review will allow you to examine the features, benefits, and downsides of every app, making it simpler to search out one of the best mileage tracker in your specific needs. Whether you’re a freelancer, small business proprietor, or employee who needs to trace miles for work, we’ve got you covered hurdlr review.

While Hurdlr is mostly a breeze to put in and use there might be the odd occasion the place a go to to the assist station could probably be needed. Thankfully, Hurdlr has accomplished a stable job with its assist middle hub, which accommodates all kinds of helpful tips, methods and advice for getting you head round all the features and features. It’s $8 per 30 days when you choose to work on a month-by-month basis. Hurdlr also comes in a Pro version, which is $10 per thirty days and is billed annually with no monthly payment option out there.

Abstract Of Customer Evaluations (takeaways): 💎

The info relating to any product was independently collected and was not provided nor reviewed by the company or issuer. The rates, phrases and costs offered are accurate at the time of publication, however these change typically. We advocate verifying with the supply to verify the hottest data. We generate income from affiliate relationships with corporations that we personally consider in. This means that, at no extra price to you, we might receives a commission whenever you click on a hyperlink.

Significantly, full-time drivers specifically actually need to have some sort of mileage tracking app if they wish to maximize their revenue. We’ll have a glance at its options, execs, cons, and see how it compares to different tools, guaranteeing you get the most out of your financial monitoring. General Hurdlr offers numerous helpful options for freelancers, gig financial system workers, and different 1099ers. Whereas the free model may be an excellent backup to have put in just in case you wish to jot down a business mileage trip or expense, I think the upgrade is in all probability going definitely value the worth. It might not do every little thing Quickbooks Self-Employed can do but its pricing reflects that — and it has some of its personal unique options to boast.

How To Choose The Best Uber Eats Bag For Food Delivery

By seeing what you owe for taxes, the Hurdlr app will let you visualize your income earlier than and after taxes. Overall, Hurdlr is a good app for anyone that should manage the financials of their enterprise easier, faster, and in a more automated means. In addition to the smartphone app, Hurdlr knowledge is on the market for review and upkeep by way of a Windows web software. Sometimes a few of these points are the trade off for simplicity. It’s most likely not cheap to anticipate a free (or $5 per month) program to be all things to all individuals. There are some accounting applications that can do a lot of what I’d wish to see.

Can observe mileage and determines how much you would get for a tax deduction for it. And can observe income and you may put your purchasers right in there. Also has the potential of estimating how much you’ll have to pay in taxes! And has reviews you’ll be able to take a look at for time intervals you wish to select for revenue and expenses, and people are all broken down for you too. Hurdlr is a mileage, earnings, and business expense monitoring app created with freelancers, rideshare drivers, real estate agents, gross sales representatives, and solopreneurs in mind. Beyond monitoring income and expenses, it helps monitor potential tax deductions and refunds.

The mileage tracker app should have good buyer help in case you might have any issues utilizing it. Ron Walter made the transfer from business supervisor at a non-profit to full time gig economy delivery in 2018 to reap the benefits of the flexibility of self-employment. He applied his thirty years experience managing and owning small companies to treat his impartial contractor role as the business it’s.